Why Low Marginal Costs Don’t Eliminate the Risk from Chargebacks

A common claim among ecommerce merchants is that their high chargeback rates are offset by low marginal costs. They trick themselves into believing their bottom line will ultimately benefit. But, left unchecked, high chargeback rates become quite costly and can threaten your ability to conduct online business.

To illustrate how high chargebacks rates can work against you, let’s look at the fundamentals.

What is a chargeback?

Let’s say a credit card holder questions a transaction and files a complaint with the issuer. If the issuer refunds the purchase amount back to the cardholder, it reverses payment made to the merchant. It will also add a fee of anywhere from $20, for processors like PayPal, up to $100. This payment reversal and fee paid by the merchant is called a chargeback.

What are the reasons for issuing a chargeback?

In some cases, chargebacks are issued because of potentially valid problems with the transaction:

- The customer pays for an order but claims they never received it.

- The customer makes a return and claims the credit did not post to their account.

- The customer cancels a recurring transaction (or forgets about it) and claims it shouldn’t be charged to their account.

- Any number of technical problems from double charging to authorization errors.

The majority of chargebacks are issued due to fraud:

- Someone uses a customer’s debit/credit card illegally.

- A customer orders from the merchant, receives the goods, and then makes a false claim about not receiving it. This is called friendly fraud.

Regardless of the reason, chargebacks are costly and inconvenient. Aside from the fee per transaction and lost shipment expenses, merchants spend time and money disputing chargeback claims. Once chargeback rates become too high, there are even more fees.

“Payment processors do not like dealing with a large number of chargebacks,” says David Fletcher, senior vice president for ClearSale. “A merchant who is struggling to control their chargeback rate could find themselves in a chargeback monitoring program.”

What is a chargeback monitoring program and how does it work?

Payment processors measure chargeback rates by tracking raw numbers and what’s called a chargeback ratio – the number of chargebacks in a single month divided by the total number of transactions in the same month. Processors set limits, or thresholds, that determine how they will respond to high chargeback rates, including chargeback monitoring programs with high fees and consequences.

VISA’s Dispute (Chargeback) Monitoring Program offers a good example of how this works.

When a merchant’s chargeback ratio is .65% or its monthly chargeback count hits 75, VISA’s early warning system notifies the merchant that its chargeback rate is concerning. This is the merchant’s chance to implement a chargeback management strategy.

If the merchant’s rate increases to .9%, or 100 chargebacks in a month, it will be placed in VISA’s Dispute Monitoring Program. Merchants then have four months to reduce their chargeback rate before a hefty fee structure kicks in (see chart).

|

Months 1-4 |

Workout period. |

|

Months 5-9 |

Visa fine of 50 USD/45 EUR per dispute |

|

Months 10-11 |

Visa fine of 50 USD/45 EUR per dispute 25,000 USD review fee (non-EU merchants only) May require audit |

|

Months 12+ |

Visa fine of 50 USD / 45 EUR per dispute 25,000 USD review fee May require audit Merchant eligible for disqualification (i.e. can no longer process Visa payments) |

It should be noted that the widely-accepted chargeback rate threshold is 1%, and VISA reduced theirs to .9% in October of 2019. Merchants should expect other processors to follow suit.

The fees get faster and more furious once a merchant’s chargeback ratio hits 1.8% or 1,000 per month. This is considered “excessive” and fees accrue much more quickly for these merchants.

|

Months 1-6 |

Visa fine of 50 USD/45 EUR per dispute |

|

Months 7-11 |

Visa fine of 50 USD/45 EUR per dispute 25,000 USD review fee (non-EU merchants only) May require audit |

|

Months 12+ |

Visa fine of 50 USD / 45 EUR per dispute 25,000 USD review fee May require audit Merchant eligible for disqualification (i.e. can no longer process Visa payments) |

How do merchants get out of chargeback monitoring programs?

To be removed from a monitoring program, merchants must consistently maintain a low chargeback rate.

With VISA’s program, that means staying below .9% for three consecutive months. But they’re not out of the woods yet. Merchants are subject to an additional three months of tracking. Crossing the .9% threshold during the tracking period will land merchants right back where they left off in the program. This can mark the point of no return, and VISA may eventually sever its relationship with the merchant.

Can merchants work with a different payment processor?

Merchants with a track record of low chargeback volumes are obviously more attractive to payment processors. News of a poor relationship with one payment processor travels fast throughout the industry, making it difficult to work with others.

In fact, gambling with ongoing high chargeback rates can earn a business the “high-risk,” label [pull quote] and a place on lists such as MasterCard’s MATCH (Member Alert to Control High-Risk Merchants) list.

MATCH is a quasi-blacklist with an average tenure of five years. With a growing dependence on ecommerce, thanks to COVID-19 and consumers’ ever-evolving purchasing behaviors, that is five years too long for most online merchants.

“Any time chargeback rates get out of control, it's always an issue,” Fletcher points out. “Merchants need to be very aware of this because getting put in one of these programs can essentially put them out of business.”

Fletcher further recommends that merchants proactively put management strategies in place to keep their chargeback rates below thresholds.

4 strategies that work (and one that doesn’t) to manage chargeback rates

Let’s start with what doesn’t work.

Do not automatically decline risky transactions

It happens often that merchants get the warning communication from their payment processor and immediately start declining transactions. This wholesale approach to mitigating high chargebacks can lead to more false declines, which have their own set of consequences.

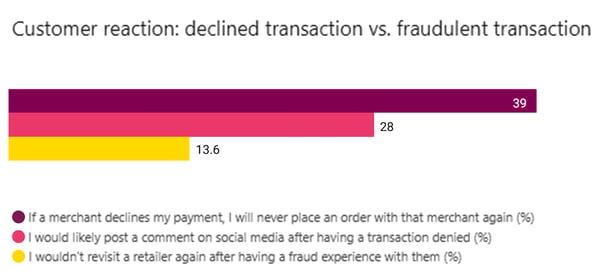

A false decline happens when a legitimate transaction is denied due to technical issues or because the purchase is suspected to be fraudulent. Up to 90% of declined transactions are actually legitimate orders, and for every $1 in losses due to credit card fraud, merchants lose $13 to false declines.

And that’s just the beginning: False declines can really anger customers. In a ClearSale/Sapio Research survey, 39% of respondents said if a merchant declines their payment, they will never place an order with that merchant again. And 28% would go to social media to complain, potentially damaging that merchant’s brand.

This doesn’t mean you should ignore risky transactions. Instead, performing a manual review of flagged transactions (instead of declining them outright) can reduce risk without irking customers.

Eliminate the confusion that leads to non-fraudulent chargebacks

Remember the potentially valid transaction problems that lead to chargebacks? Many of them can be prevented or reduced with some simple operational tweaks:

- Clarify return and refund policies so customers request a return instead of a chargeback.

- Make sure product descriptions and images are hyper-accurate so customers recognize what they receive.

- Send reminders before subscription billing so customers know they will be charged.

Transition away from mail order and telephone order transactions

If you’re still accepting mail order and telephone order (MOTO) transactions, it’s time to revisit your ecommerce strategy. MOTO transactions have an increased risk for fraudulent chargebacks because you don’t know with certainty that the person authorizing the transaction is the legitimate cardholder.

Add fraud filters to verify cardholders

Prevent fraudulent orders from processing by adding verification filters such as requiring card verification value (CVV) and a verification system to match billing and shipping addresses. Be careful, however. Some merchants will layer fraud filters in an effort to improve security, not realizing that some filters may cancel each other out.

Outsource your chargeback and fraud prevention to a trusted partner

There are a number of third-party solutions and solution providers that can help merchants struggling with high chargebacks. Some provide education and representation to help merchants negotiate with their payment processors. Others evaluate fraud risk to identify where prevention measures can be put in place. Working with a third-party to create and implement a chargeback management strategy can help keep your chargeback-related costs low so you can focus on growing your business.

David Fletcher

David Fletcher