Savvy crooks make card not present fraud a risk without end

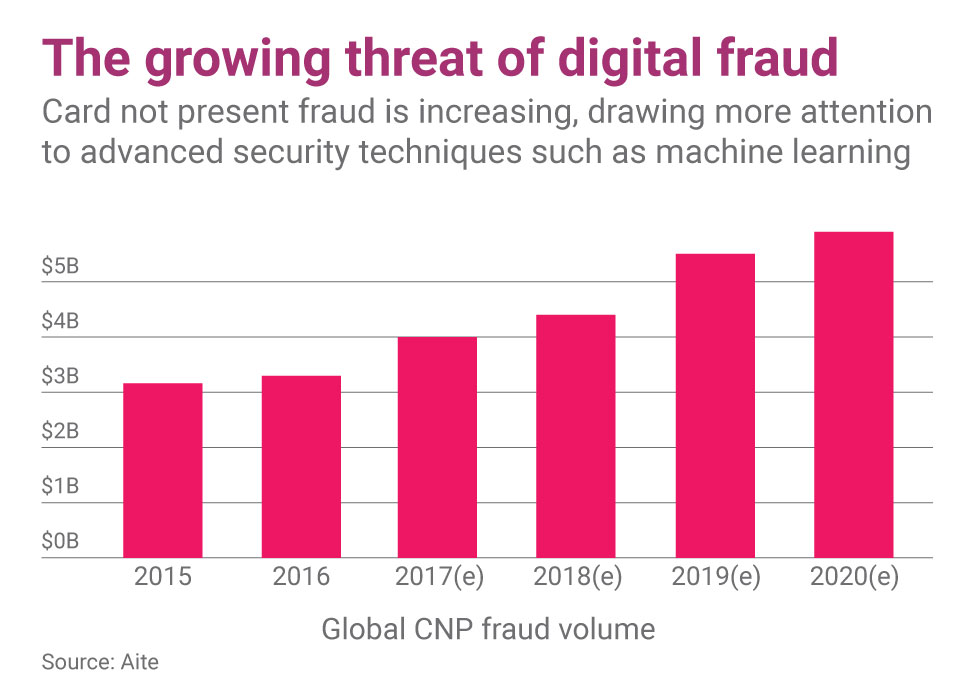

Card not present fraud is on the rise, and so is the sense of impunity that fraudsters seem to feel about their activities.

Fraud against e-commerce merchants is growing faster than the rate of e-commerce sales, and Juniper Research projects that retailers will lose $130 billion to CNP fraudbetween now and 2023.

Why is CNP fraud growing so fast? It’s no longer a matter of post-EMV migration from POS to online fraud. What we’re seeing now is brazen, organized cybercriminals leveraging technology and traditional business strategies to commit more fraud faster.

Today’s CNP criminals network online, and not only in the far recesses of the dark web. RSA recently reported that fraudsters are using the popular global messaging app Telegram in new ways to grow their criminal enterprises. Although they used to use the app for group chats to share knowledge and stolen data, RSA has found they’re also now using Telegram channels to sell their services to other would-be criminals. The new bot feature in Telegram is also being used by fraudsters to automate sales of stolen data, provide fully outsourced fraud-as-a-service and sell subscriptions to compromised card numbers and card-testing services.

Telegram isn’t the only social tool crooks are using to organize their fraud schemes.

Rafael Lourenco

Rafael Lourenco