PROTECTING YOUR ONLINE BUSINESS: CHARGEBACK FEE STATISTICS BY INDUSTRY

In the simplest of terms, a credit card chargeback is a reversal of transferred funds, or a sale that’s refunded to a customer without the disputed goods being returned to the merchant and with the merchant being charged a chargeback fee.

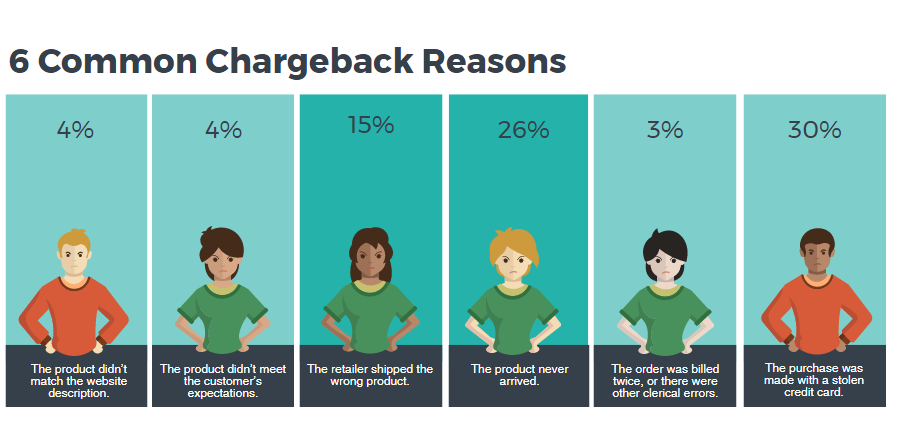

The process is initiated by a cardholder disputing a charge on their credit card, which may happen for any number of reasons. The card-issuing bank refunds the cardholder’s money and files a chargeback against your business. Although you may dispute the chargeback, the chances of your success decrease if the order was made online.

Credit card fraud results in losses of inventory and sunk shipping expenses, plus chargeback fees that can exceed $75 per dispute.

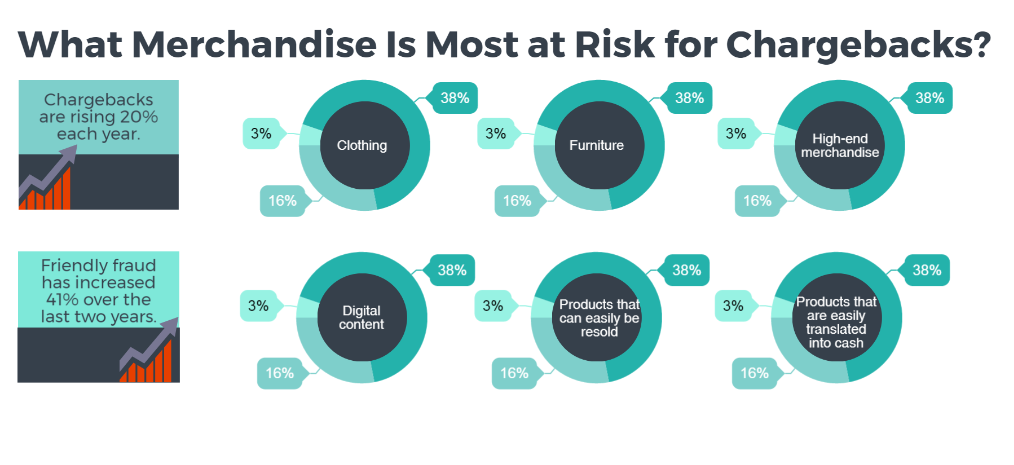

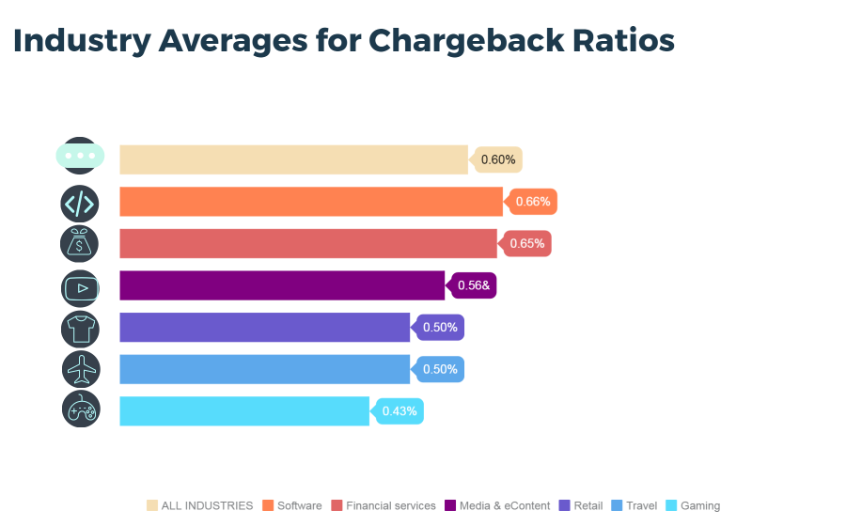

Chargebacks account for 70% of fraud and cost merchants nearly $11.2 billion in lost revenue in 2015. As a result, online merchants must be vigilant about the transactions they process, ensuring their chargeback ratios — the total number of chargebacks divided by the total number of transactions during one month — stay under 1%. Higher rates can negatively affect a business’s reputation and bottom line.

In today’s online purchasing environment, creating a frictionless checkout and encouraging transactions put merchants at an increased risk for chargebacks — threatening their growth, reputation and bottom line.

Learn more about how Clearsale’s Total Guaranteed Protection solution can guarantee you’ll never again pay for chargebacks. Email us at contact@clear.sale to find out how this solution can work for you.

Sarah Elizabeth

Sarah Elizabeth