Startling Identity Theft Statistics that Should Worry Online Merchants

If you’re an online merchant, you’re probably already aware that identity theft and credit card fraud are serious concerns. But just how serious may shock you – and experts predict it’s going to get even worse in the years to come.

If you’ve been lucky enough to elude a major fraud event thus far, we understand how you might want to dismiss the cyber threat as so much hyperbole. Unfortunately, the latest identity theft and credit fraud statistics show that it’s probably just a matter of time before your business, too, has to face this growing problem.

The Sobering Numbers

Data Breaches and Consumer Risks

Fraudsters are becoming increasingly aggressive in the way they target consumers to pursue their fraud schemes. If you’re a merchant, this means that at least some of the credit card transactions you process will be fraudulent.

The latest data isn’t encouraging:

- In 2016, more than 29 million consumer records were subject to data breaches.

- 63% of these data breaches resulted in stolen consumer credentials, such as login passwords and other identifying information.

- Hackers use stolen credentials 77% of the time.

- 1 million U.S. consumers were victims of credit card fraud in 2015. This is the second highest level it’s been in the past six years.

- A big chunk of this fraud using U.S. credit cards – 18%, or $2.4 billion – takes place outside the U.S.

- 31% of credit card fraud goes undetected by card issuers.

- Fraudsters reacted to the EMV (chip-enabled) card transition by abandoning counterfeit card schemes and instead simply opening new credit card accounts fraudulently. This drove a 113% increase in new account fraud, which now accounts for 20% of all fraud losses in the U.S.

- Fraudsters can find consumers who choose not to use transaction monitoring, email alerts, credit freezes and black market monitoring – and they use that stolen information from these consumers 75% longer, which leads to 185% higher losses for victims.

CNP Fraud

For the most part, when we talk about online credit card fraud, we’re really talking about card-not-present (CNP) fraud. Because the online shopping environment makes it very difficult for a merchant to verify a consumer’s identity, it’s far easier for a fraudster to use a stolen identity online than it is in a brick-and-mortar store.

This is a major concern for online merchants and the main reason payment processors charge merchants higher fees for CNP transactions.

If you weren’t already scared about CNP fraud, you will be once you see these numbers:

- Almost half – 45% – of all credit card fraud in the U.S. is CNP fraud.

- Losses due to CNP fraud in the U.S. totaled $2.8 billion in 2013. By 2018, that number is expected to reach a whopping $6.4 billion.

- The transition to EMV cards may be one factor behind this increase. While point-of-sale fraud has decreased in companies where the technology has been adopted, CNP fraud has skyrocketed by 300%.

- Merchants, not card issuers or consumers, bear the brunt of the cost of CNP fraud. In the U.S., merchant losses reach $1.92 billion annually to CNP fraud.

- When CNP fraud occurs, merchants find themselves not only on the hook for lost merchandise and shipping/processing expenses, but also an increase in chargebacks. These chargebacks cost merchants on average 33 times the original purchase amount – money that comes straight out of the merchant’s bottom line.

Is Your Industry Targeted?

Fraudsters typically prefer to steal products that are easy to resell, including high-cost items like upscale jewelry, electronics and clothing and low-cost items like tickets, prepaid phones and gift cards.

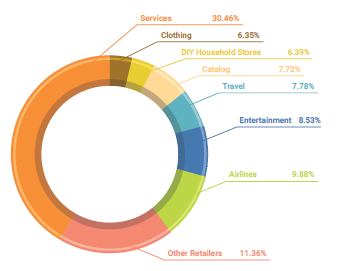

Among the types of businesses most likely to fall victim, recent data from Europe shows the following industries accounting for the highest percentages of CNP fraud:

Even if your industry isn’t represented in this diagram, the fact is that CNP fraud – like many other forms of cyber crime – is an equal-opportunity threat. Every online merchant is a potential target.

The Takeaway

These are all big numbers, and they represent a big problem for online merchants. Worse yet, CNP fraud is only one type of menace threatening your online livelihood – the statistics aren’t much prettier when it comes to data manipulation, ransomware or any other of the major fraud schemes out there.

In spite of these downbeat statistics, however, there’s still hope. The world may be a scary place, but you do have options to protect yourself and create a thriving, secure and profitable online environment.

Download our eBook, Online Credit Card Fraud Risk: The Ultimate Guide to Growing E-Commerce Sales Safely, and learn how to create the e-commerce business you want!

Sarah Elizabeth

Sarah Elizabeth